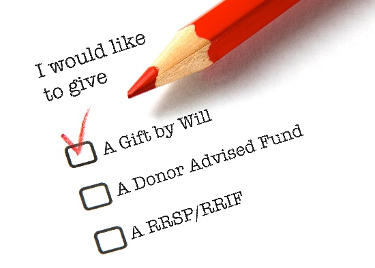

Bequests

These are gifts created in a will and are generally made after a person has provided for their loved ones and other heirs.

Gifts made by will are deemed to have been made in the year of death. Therefore, the estate receives the charitable tax credit and can offset any tax owing.

A bequest gift may be for a fixed sum or for a specified amount of the residue of the estate after other specific bequests have been distributed.

Get more information on making a bequest.

Life insurance

There are many options to use life insurance as a future gift to the Canadian Council of the Blind. Ask us about how you wish to build the future.

Get more information on making a gift of life insurance.

Life beneficiary OR registered investment

Making the Canadian Council of the Blind the beneficiary of a life insurance policy, RRSP, RRIF, or TFSA allows you to create a legacy at the Canadian Council of the Blind once your needs and those of your loved ones have been met. It is a way to create a lasting gift for the future that is easy to set up and the perfect answer to fulfill your philanthropic intentions once you have made provisions for your family and loved ones.

Get more information on making a gift of life beneficiary OR registered investments.